22 rows No upfront fees will be imposed by FMI for investments transacted through i-Invest via EPF i-Akaun while for investments made through agents the upfront fee will be reduced from a maximum of 3 to a maximum of 15. Mouse over the TRANSACTIONS tab and click on the BUY tab.

Epf Now Lets You Invest In Unit Trust Funds Directly Via I Akaun Portal Soyacincau

Se hvor raskt investeringene dine kan vokse hos Nordnet.

. 3 Select Hong Leong Asset Management. The EPF has allowed investments through i-Akaun Member to empower members who are financially literate to take control of their investments. Select your preferred FMI and complete your.

Who Can Apply Requirements Malaysians OR Permanent Residents PR OR. Members aged 55 years and abve have the option to invest part of the saving in Akaun by making Age 5560 Withdrawal Investment. Ad Kontoen er helt kostnadsfri.

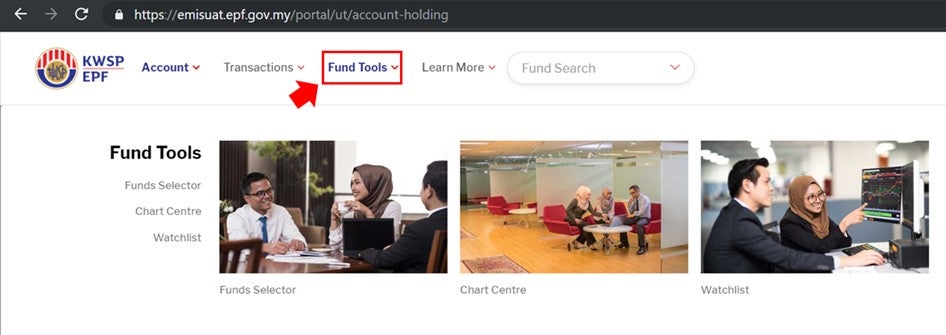

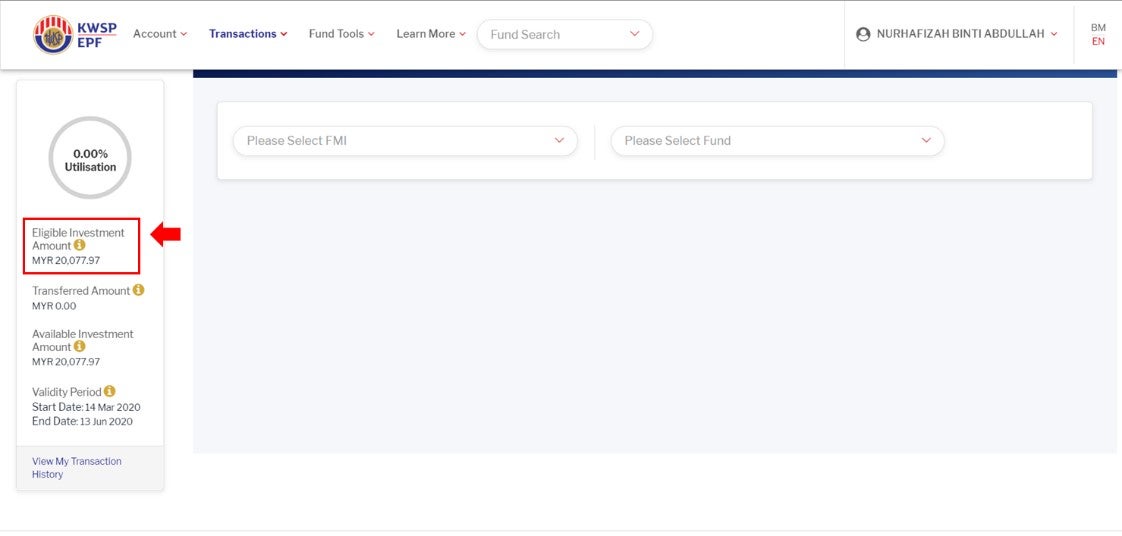

This page will also provide details of the Eligible Investment Amount and Available Investment Amount. EPFs i-Invest in 4 simple steps. Ad Best Stock Investment Tools - How You Can Earn Over 47 a Year - Learn to Invest Money.

What are the steps to invest in Kenanga Investors funds using the EPF i-Invest. This withdrawal is not part of the Members Investment Scheme. I-Invest - Employees Provident Fund.

Login to EPF i-Akaun. Se hvor raskt investeringene dine kan vokse hos Nordnet. Kom i gang i dag.

On Account Holding page proceed to Click here to start investing now or go to Transactions on the main menu and select Buy. Minimum investment is RM1000. Provident Fund EPF i-Akaun Step 1 Members need to proceed to i-Invest Step 2 Members sees a list of funds on i-Invest platform Step 3 Member who decides to make an investment will be redirected to Manulife investment to open a new account EPF i-Akaun Welcome to Manulife Investment Management 5 Fund selection Step 5 Transaction.

Refer to your latest EPF statement or. Its selling points are easy to see. 4 Select the fund s of your choice and key-in your desired investment amount.

Overfør når du vil og hvor mange ganger du vil. 2 Click Investment Transactions Buy. The EPF has also introduced an investment simulator as a tool to help members assess investment decisions based on five key parameters.

Ad Best Stock Investment Tools - How You Can Earn Over 47 a Year - Learn to Invest Money. Please refer to the Investment FAQ on the EPF Website Members personal information including the EPF Statement may not be shared with third. Via i-Invest members can choose to invest in unit trust funds offered by EPF-approved Fund Management Institutions FMIs.

The i-Invest facility was first launched back in August 2019 and sought to allow members to invest their EPF savings into unit trust funds from approved FMIs directly from their EPF i-Akaun portal. Select Investment on the menu bar. Members could previously only buy multiple unit trust funds from an FMI in a single transaction.

EPF i-Invest is the self-service online platform which allows EPF i-Akaun users to divert part of your EPF funds in unit trusts. Invest Now EPF i-Invest iSmart Invest Contact us. 1 Sales charge capped at 05 maximum I believe low sales charge is THE reason why so many EPF members bought unit trust through EPF i-Akaun.

Invest in 4 simple steps. While the numbers seem worrying EPF has launched a self-service i-Invest online platform within the EPF i-Akaun Member portal. How To Invest 1 Login to EPF i-Akaun Member.

1 Log in to your EPF i-Akaun 2 Select Investment on the menu bar 3 On the buy screen select Principal then choose your fund s You can start investing with RM1000 4 Select Principal as your preferred Fund Management Institution FMI and complete your transaction Start investing EPFs i-Invest Funds. Meanwhile members aged 55 and above can utilise i-Invest using Akaun 55 or Akaun Emas. Welcome to i-Akaun Member Frequently Asked Question FAQ i-Akaun Member Login.

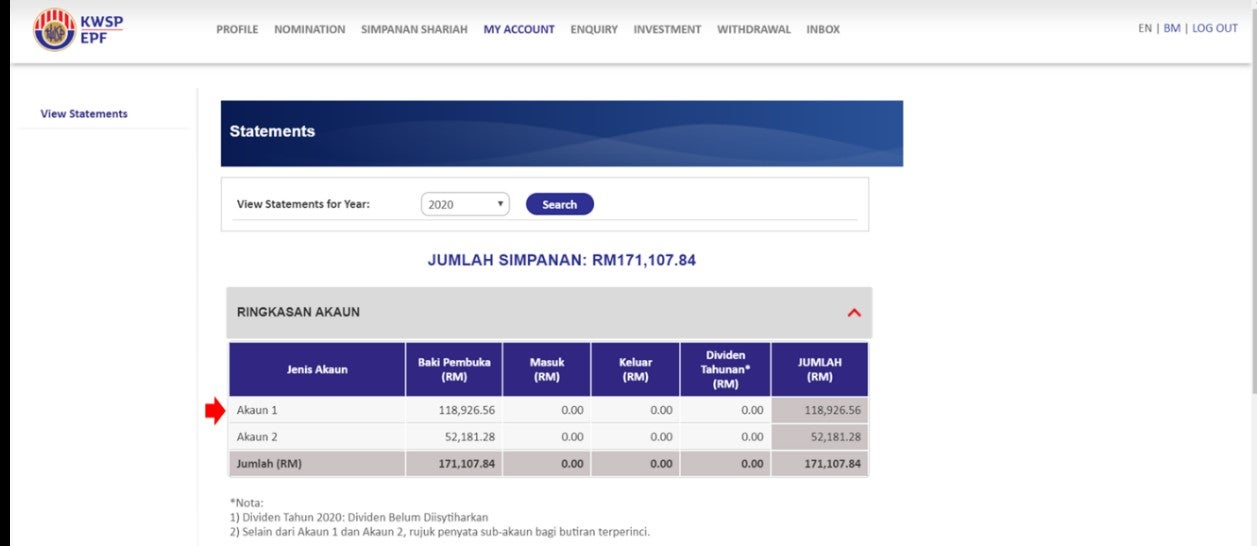

Through the i-Akaun Member you are able to analyse unit trust fund information access anytimeanywhere enjoy lower upfront fees of up to 05 versus up to 30 previously and view your fundportfolio holdings on a. The Benefits of Investing through EPF-MIS How to Invest The amount that can be invested is 30 of the savings in excess of the Basic Savings required in Account 1. On the buy screen choose your preferred funds.

Find Out if You Qualify Check your account balance at any EPF Smart Kiosk nationwide by using your MyKad or. Kom i gang i dag. Ensure that you have an Available.

2 Lots of unit trust options offered. He also said that on an average the retirement fund body has invested Rs 36000 crore in ETFs. Best Safe Investment Options FREE Advice - Get Highest Return in 2022 - FREE 200 Guide.

Overfør når du vil og hvor mange ganger du vil. First Time Login i-Akaun Activation Forgot User IDPassword. Log into your i-Akaun wwwkwspgovmy.

Via EPF i-Invest members of EPF may transfer up to 30 of the amount from their EPF Account 1 in excess of basic savings to be invested in funds approved under the EPF-MIS. A key element of the online investment facility according to Tunku Alizakri was that sales charges were now practically free as the EPF has enforced a maximum cap of 05 per cent compared to the current 3 per cent for offline and traditional transactions through agents. The evaluation will in turn assist members in making informed investment choices that correspond to their risk appetites.

We are very excited about introducing i-Invest as this digitally powered facility empowers our members to take control of their investments and make transactions at nearly zero cost said EPF Chief Executive Officer Tunku Alizakri Alias in. Select i-Invest tab on the top menu bar. Last year EPF introduced the i-Invest self-service online investment facility which allows members to buy up to eight unit trust funds from up to five Fund Management Institutions FMIs in one transaction.

Click on the INVESTMENT tab. Investment objectives can now be simulated based on a members choice of the initial investment amount monthly investment amount investment period rate of return or ending investment value. Best Safe Investment Options FREE Advice - Get Highest Return in 2022 - FREE 200 Guide.

Log in to EPF i-Akaun. Ad Kontoen er helt kostnadsfri. Select AmFunds Management Bhd on.

Union Minister of State for Labour and Employment Rameswar Teli informed Parliament earlier this week that the Employees Provident Fund Organisation EPFO has made Rs 6761972 crore by investing in exchange traded funds ETFs till 31 March this year. Log into i-Akaun Select Investment tab to proceed Select Transaction and subsequently Buy tab Select Kenanga Investors Berhad on Please Select FMI Select your fund from Please Select Fund Enter amount and select Proceed to checkout. You have a particular fund in mind.

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf I Invest Features You May Not Know About

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf How To Apply For Epf I Invest Mypf My

Predicting The Next Market Crash Using Shiller P E Ratio

Epf Members Can Track Investment Performance Returns Online

How Epf Digitalising Its Customer Journey

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf I Invest Features You May Not Know About

Epf I Invest Features You May Not Know About

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube

Pelaburan Unit Amanah Islam Kelayakan Skim Pelaburan Ahli Kwsp Untuk Pelaburan Dalam Unit Amanah Unit Trust Islam Sejarah Malaysia